Explain this easy in 100000 words For the transaction to qualify as nontaxable under § 351, the property transferors must control the corporation immediately after the exchange. Specifically, the property transferors must own stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock. Control Immediately after the Transfer Control after the exchange can apply to a single person or to several taxpayers if they are all parties in an integrated transaction. To satisfy the timing requirement, when more than one person is involved, the exchange does not necessarily require simultaneous exchanges by those persons. However, the rights of those transferring property to the corporation must be previously set out and determined. Also, the shareholders should execute the agreement to transfer property “with an expedition consistent with orderly procedure,” and the transfers should occur close together in time. Example 5 Jack exchanges property with a basis of $60,000 and fair market value of $100,000 for 70% of the stock of Gray Corporation. The other 30% of the stock is owned by Jane, who acquired it several years ago. The fair market value of Jack’s stock is $100,000. Jack recognizes a taxable gain of $40,000 on the transfer because he does not control the corporation after his transfer, and his transaction cannot be integrated with Jane’s for purposes of the control requirement. Example 6 The Big Picture Return to the facts of The Big Picture. Assume that the proposed transaction involving Emily and Ethan occurs as described. However, in addition, Marco decides to contribute property to the new corporation in exchange for an equity interest. As a result, Emily exchanges her property for 200 shares of Transformation, Inc. stock on January 7, 2023, Marco exchanges his property for 10 shares of Transformation stock on January 14, 2023, and Ethan exchanges his property for 4,800 shares in Transformation on March 5, 2023. Because the three exchanges are part of a prearranged plan and the control test is met, the nonrecognition provisions of § 351 apply to all of the exchanges. Once control has been achieved, it is not necessarily lost if, shortly after the transaction, stock received by shareholders is sold or given to persons who are not parties to the exchange. Example 7 Naomi and Eric form Eagle Corporation. They transfer appreciated property to the corporation with each receiving 50 shares of Eagle stock. Shortly after the formation, Naomi gives 25 shares to her son. Because Naomi was not committed to making the gift, she met the control test “immediately after the exchange.” Therefore, Naomi and Eric meet the requirements of § 351, and neither recognizes gain on the exchange. The following two examples show that a different result occurs if a plan for the ultimate disposition of the stock existed before the exchange. In other words, momentary control on the part of the transferor may not suffice if loss of control is required by a prearranged agreement. Example 8 The Impact of a Preconceived Plan on the Control Requirement Assume the same facts as in Example 7, except that Naomi immediately gives 25 shares to a business associate pursuant to a plan to satisfy an outstanding obligation. In this case, Naomi fails the “immediately” condition and so the control test calculation excludes her shares. Accordingly, the formation of Eagle is taxable to Naomi and Eric because they jointly own only 75% of the stock. Example 9 The Impact of a Preconceived Plan on the Control Requirement For many years, Paula operated a business as a sole proprietor employing Brooke as manager. To dissuade Brooke from quitting and going out on her own, Paula promised her a 30% interest in the business. To fulfill this promise, Paula transfers the business to newly formed Green Corporation in return for all of its stock. Immediately thereafter, Paula transfers 30% of the stock to Brooke. Code § 351 probably does not apply to Paula’s transfer to Green Corporation because it appears that Paula was under an obligation to relinquish control. If this preexisting obligation exists, § 351 will not be available to Paula because, as the sole property transferor, she does not have 80% control of Green Corporation. However, if there is no obligation and the loss of control was voluntary on Paula’s part, momentary control would suffice. Stock need not be issued to the property transferors in the same proportion as the relative value of the property transferred by each. However, when stock received is not proportionate to the value of the property transferred, the taxpayers must properly recognize the economic effects of the transactions. For example, in such situations, one transferor may actually be making a gift to another transferor. Example 10 Noah and Sydney, father and daughter, form Oak Corporation. Noah transfers property worth $50,000 in exchange for 100 shares of stock, and Sydney transfers property worth $50,000 for 400 shares of stock. The transfers qualify under § 351 because Noah and Sydney have control of the Oak stock immediately after the transfers of property. However, Noah and Sydney must recognize and properly characterize Noah’s implicit gift of 150 shares to Sydney. As such, the value of the gift might be subject to the gift tax (see Chapter 29). Transfers for Property and Services Examples 5, 8, and 9 show that taxpayers can lose § 351 treatment if persons who do not transfer property own “too much” stock. Example 11 shows how a service contributor also can cause a property contributor to fail the control test and thus have to recognize gain. Example 11 Sarah transfers property with a basis of $400,000 and fair market value of $1,000,000 to Garden, Inc., and receives 50% of its stock. Tiffany receives the other 50% of the stock for services rendered (worth $1,000,000). Tiffany has ordinary income of $1,000,000 because she contributes only services. She must recognize compensation income for services rendered. Sarah contributes property, but she receives only 50% of Garden’s stock. Because Sarah does not own at least 80% of Garden’s stock, she has a taxable gain of $600,000 [$1,000,000 (fair market value of the stock in Garden) − $400,000 (basis in the transferred property)]. As noted earlier, a person contributing both services and property in exchange for corporate stock must include in taxable income the value of the stock received for the services but not the value of the stock received for the property, assuming the property transferors control the corporation. In addition, the law allows treating such a person as a “property transferor.” In these situations, all stock received by the person transferring property and services counts toward whether the transferors control the corporation. Example 12 Assume the same facts as in Example 11, except that Tiffany transfers property worth $800,000 (basis of $260,000) in addition to services rendered to Garden, Inc. (valued at $200,000). Now Tiffany becomes a part of the control group. Sarah and Tiffany, as property transferors, together own 100% of the corporation’s stock. Consequently, § 351 applies to the exchanges. Note that the control test calculation includes all of Tiffany’s shares and not just the shares that relate to her property contribution. As a result, Sarah recognizes no gain. Tiffany does not recognize gain on the transfer of the property, but she recognizes ordinary income to the extent of the value of the shares issued for services rendered. Thus, Tiffany recognizes $200,000 of ordinary income currently. Transfers for Services and Nominal Property Note that to be part of the group meeting the 80 percent control test, the person contributing services must transfer property having more than a “relatively small value” compared with the services performed. When the primary purpose of the transfer is to qualify the transaction under § 351, the Regulations provide that the control test calculation will ignore stock issued for property whose value is relatively small compared with the value of services rendered. The regulations do not define a “relatively small” property contribution. The IRS has stated that the control group includes a person who contributes both property and services only if the value of the property equals or exceeds 10 percent of the value of the services provided. If the value of the property transferred is less than this amount, the IRS is likely to treat the property contributed as having a relatively small value and disregard it in applying the control test. A similar 10 percent rule applies when an existing shareholder contributes property so that another person meets the control test. That is, the new stock issued for the newly-contributed property must equal or exceed 10 percent of the value of the old stock already owned. Example 15 illustrates this rule. Example 13 Determining Control Group Membership When Services Are Rendered Ava and Rick form Grouse Corporation. Ava transfers land worth $100,000 with a basis of $20,000. Rick transfers equipment worth $50,000 with an adjusted basis of $10,000 and provides services worth $50,000. Ava and Rick each receive 50% of the Grouse stock. Because the value of the property Rick transfers is not small relative to the value of the services he renders, his stock in Grouse Corporation is counted in determining control under § 351; thus, Ava and Rick jointly own 100% of the stock in Grouse. In addition, all of Rick’s stock, not just the shares received for the equipment, counts in determining control. As a result, Ava does not recognize gain on the transfer of the land. Rick similarly does not recognize the gain on his equipment; however, he must recognize income of $50,000 on the transfer of services. Even though the transfer of the equipment qualifies Rick as a property contributor under § 351, his transfer of services for stock is still taxable compensation income. Example 14 Determining Control Group Membership When Services Are Rendered Assume the same facts as in Example 13, except that the value of Rick’s property is $2,000 and the value of his services is $98,000. In this situation, the value of the property is small relative to the value of the services (and well below the 10% IRS threshold); therefore, Rick does not qualify as a property transferor. Consequently, the transaction is fully taxable to both Ava and Rick. In this situation, Ava, the sole property transferor, lacks at least 80% control of Grouse Corporation following the transfer. As a result, she will fully recognize her realized gain. Further, because the control test ignores Rick’s shares, the § 351 deferral is not available to him. He will recognize income of $98,000 relating to the services provided along with any realized gain or loss on the transfer of the additional $2,000 of property. Transfers to Existing Corporations Once a corporation is operational, § 351 also applies to any later transfers of property for stock by either new or existing shareholders. That is, § 351 does not apply solely at the time of corporate formation. Example 15 Tyrone and Andrew formed Blue Corporation three years ago. Both Tyrone and Andrew transferred appreciated property to Blue in exchange for 50 shares each in the corporation. The original transfers qualified under § 351, and neither Tyrone nor Andrew recognizes gain or loss on the exchange. In the current year, Tyrone transfers property (worth $90,000, adjusted basis of $5,000) for 50 additional Blue shares. Tyrone has a taxable gain of $85,000 on the transfer. The exchange does not qualify under § 351 because Tyrone does not have 80% control of Blue Corporation immediately after the transfer—he owns 100 shares of the 150 shares outstanding, or a 66⅔% interest. But what if Tyrone asked Andrew also to contribute property? In this case, Tyrone and Andrew would own 100% of the stock and both would qualify again for tax deferral. This “accommodation transfer” result holds only if Andrew’s new stock value exceeds 10% of the value of his old stock.

Sure, let's break down the key points of Section 351 in a simpler and more digestible format. I'll cover the main concepts and provide examples to illustrate each point. ### Key Points of Section 351 #### 1. **Control Requirement** - **Definition**: To qualify for non-recognition of gain or loss under Section 351, the property transferors must control the corporation immediately after the exchange. - **80% Rule**: Control means owning at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock. - **Timing**: Control must be established immediately after the transfer. This can involve multiple people as long as their actions are part of a prearranged plan. #### 2. **Integrated Transactions** - **Single or Multiple Parties**: Control can be achieved by a single person or multiple taxpayers if they are part of an integrated transaction. - **Prearranged Plan**: The rights and obligations of those transferring property must be predetermined, and the transfers should occur close together in time. #### 3. **Examples of Control** - **Example 1**: Jack exchanges property for 70% of the stock in Gray Corporation, but Jane owns the remaining 30%. Jack does not meet the control requirement and recognizes a taxable gain. - **Example 2**: Emily, Marco, and Ethan exchange property for stock in Transformation

Get your tax questions answered

Main Features

Instant Expert Advice

Get quick and accurate answers to your tax questions from our team of tax experts and artificial intelligence.

Convenient and Easy to Use

Our chatbot interface makes it easy to ask questions and get answers whenever and wherever you want.

Free Tax Question Answers

Our service is 100% risk-free, and our AI will answer all of your tax questions for free.

Fast & Accurate Answers

Our easy to use chatbot or call-in line gets you the help you need in just a few minutes. And our advanced AI makes sure that the answers you need are as accurate as possible.

ZeroTax.ai's Call-In Service

You can also get your tax questions answered by calling our phone number 855-724-1040 and speaking directly to our AI assistant on the phone! We understand that sometimes it's easier to ask your questions verbally, and we want to make sure that our service is accessible to everyone. Don't let tax questions stress you out any longer. Call us at 855-724-1040 now and let ZeroTax.ai help you.

Safe and Secure

We always make sure your information is safe by using the latest encryption technology.

Tax Pro Reviews Available

If you want a tax expert to review your answer at a low cost, we can do that for just $5 per question.

100% Satisfaction Guarantee

We're convinced of our service and back it up with a no-questions-asked 100% satisfaction guarantee.

100% Satisfaction Guarantee

Our lightning-fast tax help service is backed by a team of tax professionals who can review all answers for accuracy and completeness. We're so confident in the quality of our service, we offer you a 100% no-questions asked satisfaction guarantee.

If you're not completely satisfied with your tax answer, we'll gladly refund or credit your fee. We stand behind our service. Your satisfaction is our top priority!

Our customers get results

100%

Customer Satisfaction

100%

Questions Answered

100%

Time Saved

What customers are saying

ZeroTax.ai is a game-changer for my tax questions. Quick, accurate answers from AI and real tax pros.

Sukhtej Sidhu

Senior Analyst

I was hesitant to try a chatbot for tax advice, but ZeroTax.ai exceeded my expectations.

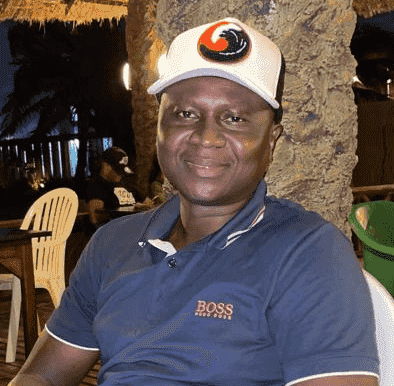

Lamin Ceesay

Painter

I've recommended ZeroTax.ai to all my colleagues. The convenience and expertise is unmatched.

Philip Kempisty, CPA

Entrepreneur

Affordable Tax Help

AI tax answers are 100% free, optional $50 tax pro reviews

Our service is accessible to all with free AI generated tax answers, and prices of just $5 per question if you want an optional tax pro review! Don't let taxes stress you out any longer - let ZeroTax.ai help you today.

AI Answered Tax Questions

100% Free

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.

- All AI tax questions answered free

- No commitment or long-term contract

- Answers in seconds

Tax Pro Reviewed Answers

Only $50

Affordable, expert tax advice for just $50 per question. Get the answers you need easily with our human-reviewed service.

- Tax professional reviewed answers

- Confirming the AI answer accurate

- Responses with in 24 hours

Our Technology

How does AI work?

Well, imagine a giant brain made up of millions of lines of code. This brain is constantly learning and analyzing vast amounts of tax-related information. When you ask your question, our technology quickly cross-references millions of pieces of tax information to find you the most relevant and up-to-date answer.

And it's even more advanced than that. Our AI technology is able to understand the written language context of your question. It takes into account your specific circumstances and provides you with tailored recommendations incorporated into your answer.

Think of it as having a personal tax expert right at your fingertips, available 24/7 to provide you with the tax information you need. Plus, our system is self-learning and constantly improving, ensuring that you always receive the most accurate advice.

Tax Tips and Tricks Right to Your Inbox

Sign up for our exclusive tax tips and tricks and always get the latest tax strategies, updates, and promotions. Don't miss out on this valuable information that will save you money and time. Tax gold right to your email.

Ready to ask your tax question?

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.