In the context of tax deductions for a business vehicle, "actual expenses" typically refer to the ongoing costs of operating the vehicle, such as gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation. The costs for body repair and restoration would generally not be considered as "actual expenses" for the purpose of vehicle operation in a given tax year. Instead, the body repair and restoration costs would likely be capitalized and added to the basis of the vehicle. These costs are not immediately deductible as an expense in the year they are incurred if they are part of a major restoration or improvement that adds value to the vehicle or substantially prolongs its life. Once the restoration is complete and the truck is placed in service for your business, you can begin depreciating the total cost of the vehicle, including the restoration costs, over its useful life according to IRS guidelines. The truck does not need to be in use by the business to incur these restoration costs, but it does need to be placed in service before you can start taking depreciation deductions. Keep in mind that if the truck is used for both personal and business purposes, you must allocate the costs and only deduct the portion that applies to the business use. It's important to keep detailed records of all expenses and the business use of the vehicle to substantiate your deductions. Always consult with a tax professional to ensure you are applying the tax rules correctly to your specific situation. Would you like this answer sent to your email? No Would you like your answer to be reviewed and verified by a tax professional for only $50? No Do you have another tax question you'd like answered? Yes Is your question a follow up to your previous question or on a new topic? No, this is about a new topic Ask your question here: Questions may be used for content creation. i own three classic cars and want to earn income renting them out. Two of the cars need a major restoration. How can i deduct the expenses of restoration from my taxes?

If you're planning to rent out your classic cars as part of a business, the costs associated with restoring those vehicles can be considered part of your business expenses. However, the way these expenses are deducted can vary depending on the nature of the restoration: 1. **Repairs vs. Improvements**: The IRS distinguishes between repairs and improvements. Repairs are typically deductible in the year they are made because they keep your property in good operating condition without materially adding value or prolonging its life. Improvements, on the other hand, add value to the car, prolong its useful life, or adapt it to new uses and must be capitalized and depreciated over time. 2. **Capitalized Costs**: Major restorations are often considered improvements. This means you would add the cost of the restoration to the basis (the value for tax purposes) of each car. You would then depreciate this cost over the useful life of the vehicle as determined by IRS guidelines. 3. **Depreciation**: Once the cars are restored and ready for use in your rental business, you can begin to depreciate them. The IRS has specific guidelines on how to calculate depreciation for business vehicles, including the Modified Accelerated Cost Recovery System (MACRS). 4. **Business Use**: To deduct these expenses, the cars must be used for business purposes. If they are also used for personal purposes, you can only deduct the portion of the expenses that apply to the business use. 5. **Record-Keeping

Get your tax questions answered

Main Features

Instant Expert Advice

Get quick and accurate answers to your tax questions from our team of tax experts and artificial intelligence.

Convenient and Easy to Use

Our chatbot interface makes it easy to ask questions and get answers whenever and wherever you want.

Free Tax Question Answers

Our service is 100% risk-free, and our AI will answer all of your tax questions for free.

Fast & Accurate Answers

Our easy to use chatbot or call-in line gets you the help you need in just a few minutes. And our advanced AI makes sure that the answers you need are as accurate as possible.

ZeroTax.ai's Call-In Service

You can also get your tax questions answered by calling our phone number 855-724-1040 and speaking directly to our AI assistant on the phone! We understand that sometimes it's easier to ask your questions verbally, and we want to make sure that our service is accessible to everyone. Don't let tax questions stress you out any longer. Call us at 855-724-1040 now and let ZeroTax.ai help you.

Safe and Secure

We always make sure your information is safe by using the latest encryption technology.

Tax Pro Reviews Available

If you want a tax expert to review your answer at a low cost, we can do that for just $5 per question.

100% Satisfaction Guarantee

We're convinced of our service and back it up with a no-questions-asked 100% satisfaction guarantee.

100% Satisfaction Guarantee

Our lightning-fast tax help service is backed by a team of tax professionals who can review all answers for accuracy and completeness. We're so confident in the quality of our service, we offer you a 100% no-questions asked satisfaction guarantee.

If you're not completely satisfied with your tax answer, we'll gladly refund or credit your fee. We stand behind our service. Your satisfaction is our top priority!

Our customers get results

100%

Customer Satisfaction

100%

Questions Answered

100%

Time Saved

What customers are saying

ZeroTax.ai is a game-changer for my tax questions. Quick, accurate answers from AI and real tax pros.

Sukhtej Sidhu

Senior Analyst

I was hesitant to try a chatbot for tax advice, but ZeroTax.ai exceeded my expectations.

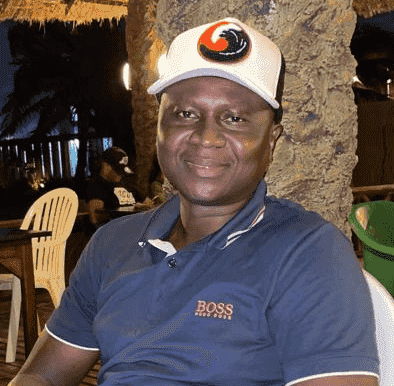

Lamin Ceesay

Painter

I've recommended ZeroTax.ai to all my colleagues. The convenience and expertise is unmatched.

Philip Kempisty, CPA

Entrepreneur

Affordable Tax Help

AI tax answers are 100% free, optional $50 tax pro reviews

Our service is accessible to all with free AI generated tax answers, and prices of just $5 per question if you want an optional tax pro review! Don't let taxes stress you out any longer - let ZeroTax.ai help you today.

AI Answered Tax Questions

100% Free

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.

- All AI tax questions answered free

- No commitment or long-term contract

- Answers in seconds

Tax Pro Reviewed Answers

Only $50

Affordable, expert tax advice for just $50 per question. Get the answers you need easily with our human-reviewed service.

- Tax professional reviewed answers

- Confirming the AI answer accurate

- Responses with in 24 hours

Our Technology

How does AI work?

Well, imagine a giant brain made up of millions of lines of code. This brain is constantly learning and analyzing vast amounts of tax-related information. When you ask your question, our technology quickly cross-references millions of pieces of tax information to find you the most relevant and up-to-date answer.

And it's even more advanced than that. Our AI technology is able to understand the written language context of your question. It takes into account your specific circumstances and provides you with tailored recommendations incorporated into your answer.

Think of it as having a personal tax expert right at your fingertips, available 24/7 to provide you with the tax information you need. Plus, our system is self-learning and constantly improving, ensuring that you always receive the most accurate advice.

Tax Tips and Tricks Right to Your Inbox

Sign up for our exclusive tax tips and tricks and always get the latest tax strategies, updates, and promotions. Don't miss out on this valuable information that will save you money and time. Tax gold right to your email.

Ready to ask your tax question?

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.