John is employed by Surf plc. The following information is available for the tax year 2022/23: (1) During the tax year 2022/23, John was promoted and paid gross remuneration of £328,318. In each of the tax years 2019/20, 2020/21 and 2021/22 his adjusted income was below £150,000. (2) During the tax year 2022/23, John contributed £18,000 into Surf plc's occupational pension scheme. The company contributed a further £12,000 on his behalf. Both John and Surf ple have made exactly the same contributions for the previous five tax years. (3) During 2019 Surf plc provided John with a loan which was used to purchase a yacht. The amount of loan outstanding at 6 April 2022 was £84,000. John repaid £12,000 of the loan on 31 July 2022, and then repaid a further £12,000 on 31 December 2022. He paid loan interest of £90 to Surf ple during the tax year 2022/23. The taxable benefit in respect of this loan is calculated using the average method. (4) During the tax year 2022/23, John made personal pension contributions up to the maximum amount of available annual allowances, including any unused amounts brought forward from previous years. These contributions were in addition to the contributions he made to Surf plc's occupational pension scheme (see note (2)). John has not made any personal pension contributions in previous tax years. (5) John owns a holiday cottage which is let out as a furnished holiday letting, although the letting does not qualify as a trade under the furnished holiday letting rules. The property business profit for the year ended 5 April 2023 was £14,855 before taking into account interest and £1,875 paid to a letting agent. John paid loan interest of £7,500 for the year in respect of a loan to buy this property. Required (a) Calculate John's income tax liability for the tax year 2022/23.

To calculate John's income tax liability for the tax year 2022/23, we need to consider his various sources of income, pension contributions, and allowable deductions. Here's a step-by-step breakdown: 1. Employment Income: Gross remuneration: £328,318 2. Pension Contributions: John's personal contributions to the occupational pension scheme: £18,000 Surf plc's contributions on John's behalf: £12,000 Total pension contributions: £30,000 The annual allowance for pension contributions is £40,000 for the tax year 2022/23. However, for individuals with adjusted income over £240,000, the annual allowance is tapered. John's income exceeds this threshold, so his annual allowance will be reduced. For every £2 of adjusted income over £240,000, the annual allowance is reduced by £1, down to a minimum of £4,000. John's adjusted income is £328,318, which is £88,318 over the threshold. Tapered annual allowance calculation: £88,318 / 2 = £44,159 (excess over £240,000) £40,000 (standard annual allowance) - £44,159 (excess) = Reduced annual allowance (cannot be less than £4,000) Since the reduction would exceed the standard annual allowance, John's annual allowance is reduced to the minimum of £4,000. John's personal pension contributions are

Get your tax questions answered

Main Features

Instant Expert Advice

Get quick and accurate answers to your tax questions from our team of tax experts and artificial intelligence.

Convenient and Easy to Use

Our chatbot interface makes it easy to ask questions and get answers whenever and wherever you want.

Free Tax Question Answers

Our service is 100% risk-free, and our AI will answer all of your tax questions for free.

Fast & Accurate Answers

Our easy to use chatbot or call-in line gets you the help you need in just a few minutes. And our advanced AI makes sure that the answers you need are as accurate as possible.

ZeroTax.ai's Call-In Service

You can also get your tax questions answered by calling our phone number 855-724-1040 and speaking directly to our AI assistant on the phone! We understand that sometimes it's easier to ask your questions verbally, and we want to make sure that our service is accessible to everyone. Don't let tax questions stress you out any longer. Call us at 855-724-1040 now and let ZeroTax.ai help you.

Safe and Secure

We always make sure your information is safe by using the latest encryption technology.

Tax Pro Reviews Available

If you want a tax expert to review your answer at a low cost, we can do that for just $5 per question.

100% Satisfaction Guarantee

We're convinced of our service and back it up with a no-questions-asked 100% satisfaction guarantee.

100% Satisfaction Guarantee

Our lightning-fast tax help service is backed by a team of tax professionals who can review all answers for accuracy and completeness. We're so confident in the quality of our service, we offer you a 100% no-questions asked satisfaction guarantee.

If you're not completely satisfied with your tax answer, we'll gladly refund or credit your fee. We stand behind our service. Your satisfaction is our top priority!

Our customers get results

100%

Customer Satisfaction

100%

Questions Answered

100%

Time Saved

What customers are saying

ZeroTax.ai is a game-changer for my tax questions. Quick, accurate answers from AI and real tax pros.

Sukhtej Sidhu

Senior Analyst

I was hesitant to try a chatbot for tax advice, but ZeroTax.ai exceeded my expectations.

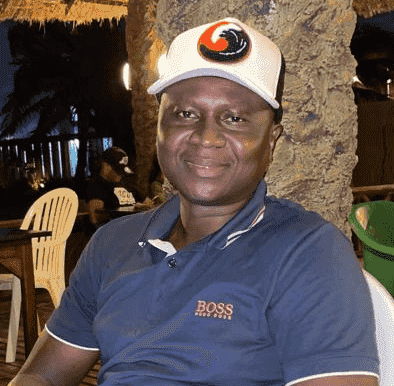

Lamin Ceesay

Painter

I've recommended ZeroTax.ai to all my colleagues. The convenience and expertise is unmatched.

Philip Kempisty, CPA

Entrepreneur

Affordable Tax Help

AI tax answers are 100% free, optional $50 tax pro reviews

Our service is accessible to all with free AI generated tax answers, and prices of just $5 per question if you want an optional tax pro review! Don't let taxes stress you out any longer - let ZeroTax.ai help you today.

AI Answered Tax Questions

100% Free

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.

- All AI tax questions answered free

- No commitment or long-term contract

- Answers in seconds

Tax Pro Reviewed Answers

Only $50

Affordable, expert tax advice for just $50 per question. Get the answers you need easily with our human-reviewed service.

- Tax professional reviewed answers

- Confirming the AI answer accurate

- Responses with in 24 hours

Our Technology

How does AI work?

Well, imagine a giant brain made up of millions of lines of code. This brain is constantly learning and analyzing vast amounts of tax-related information. When you ask your question, our technology quickly cross-references millions of pieces of tax information to find you the most relevant and up-to-date answer.

And it's even more advanced than that. Our AI technology is able to understand the written language context of your question. It takes into account your specific circumstances and provides you with tailored recommendations incorporated into your answer.

Think of it as having a personal tax expert right at your fingertips, available 24/7 to provide you with the tax information you need. Plus, our system is self-learning and constantly improving, ensuring that you always receive the most accurate advice.

Tax Tips and Tricks Right to Your Inbox

Sign up for our exclusive tax tips and tricks and always get the latest tax strategies, updates, and promotions. Don't miss out on this valuable information that will save you money and time. Tax gold right to your email.

Ready to ask your tax question?

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.