Kelly and Chanelle Chambers, ages 47 and 45, are married and live at 584 Thoreau Drive, Boston, MA 59483. Kelly’s Social Security number is 111-11-1111 and Chanelle’s is 222-22-2222. The Chambers have two children: Emma, age 23, and Chet, age 19. Their Social Security numbers are 333-33-3333 and 444-44-4444, respectively. Emma is a single college student and earned $8,000 during the summer. Kelly and Chanelle help Emma through school by paying for her room, board, and tuition. Emma lives at home during the summer. Chet has a physical handicap and lives at home. He attends a local university and earned $4,000 working for a marketing firm. In sum, Kelly and Chanelle provide more than 50% of both Emma’s and Chet’s total support for the year. Kelly is a commercial pilot for a small airline. His salary is $95,000, from which $19,000 of federal income tax and $8,000 of state income tax were withheld. Kelly also pays premiums for health, disability, and life insurance. $2,000 of the premium was for health insurance, $250 for disability, and $400 for life insurance. Chanelle owns Alliance Networks, a proprietorship that does network consulting. During the year, Chanelle’s gross revenues were $23,000. She incurred the following ex-penses in her business: Liability insurance $ 700 Software rental 5,400 Journals and magazines 150 Training seminars 1,200 Supplies 1,300 Donations to a political campaign fund 800 Kelly enjoys playing guitar and plays in a band. Kelly’s band has developed a local following. This year, his gross revenues were $1,200 for playing shows and $700 on CD sales. He incurred the following expenses: Studio rent expense $1,300 Sound system repairs 200 CD production 500 New guitar and amplifier 800 Kelly’s father passed away during the year. Kelly and Chanelle received $100,000 from the life insurance policy. Neither Kelly nor Chanelle paid any of the premiums. Chanelle purchased 100 shares of Thurston Co. stock on May 1, 1993, for $1,000. Thurston Co. was declared bankrupt during the current year. Chet’s physician recommended that he see a physical therapist to help with his dis-ability. Kelly paid the therapist $7,000 during the year because his insurance would not cover the bills. Kelly and Chanelle went to Las Vegas and won $5,000 at the blackjack table. The next night, they lost $6,000. Kelly and Chanelle gave $900 to their church and, during the year, they had the fol-lowing other income and expenses: Real estate taxes $1,400 Property taxes on car (determined by value) 500 Home mortgage interest 12,000 Credit card finance charges 2,600 Tax return preparation fees ($600 is allocable to Chanelle’s business) 1,000 Sales tax on purchases during the year 6,200 Interest from a savings account 800 Interest from City of Boston Bonds 700 Dividend from 3M stock 400 Prepare Kelly and Chanelle’s tax return Form 1040 and Schedules A, B, C, D and SE for 2022. Assume the couple had no transactions involving virtual currency.

I'm sorry for any confusion, but as an AI text model, I'm unable to physically prepare tax forms. However, I can provide some guidance on how to approach this. 1. **Form 1040**: This is the main form where you report your income, deductions, and credits. Kelly and Chanelle's income from salaries, business, and other sources like interest and dividends will be reported here. 2. **Schedule A**: This is where you itemize deductions. The Chambers can include their home mortgage interest, real estate taxes, property taxes, and charitable contributions. However, they cannot deduct their credit card finance charges, losses from gambling, or sales tax (unless they choose to deduct sales tax instead of state income tax). 3. **Schedule B**: This is for reporting interest and dividend income. The interest from the savings account and City of Boston Bonds, and the dividend from 3M stock will be reported here. 4. **Schedule C**: This is for reporting profit or loss from a business. Chanelle will report her gross revenue and business expenses here. Kelly will also report his band income and expenses here. Note that political donations are not deductible as business expenses. 5. **Schedule D**: This is for reporting capital gains and losses. Chanelle's loss from the Thurston Co. stock will be reported here. 6. **Schedule SE**: This is for self-employment tax. Both Kelly (for his band income) and Chanelle (for her business

Get your tax questions answered

Main Features

Instant Expert Advice

Get quick and accurate answers to your tax questions from our team of tax experts and artificial intelligence.

Convenient and Easy to Use

Our chatbot interface makes it easy to ask questions and get answers whenever and wherever you want.

Free Tax Question Answers

Our service is 100% risk-free, and our AI will answer all of your tax questions for free.

Fast & Accurate Answers

Our easy to use chatbot or call-in line gets you the help you need in just a few minutes. And our advanced AI makes sure that the answers you need are as accurate as possible.

ZeroTax.ai's Call-In Service

You can also get your tax questions answered by calling our phone number 855-724-1040 and speaking directly to our AI assistant on the phone! We understand that sometimes it's easier to ask your questions verbally, and we want to make sure that our service is accessible to everyone. Don't let tax questions stress you out any longer. Call us at 855-724-1040 now and let ZeroTax.ai help you.

Safe and Secure

We always make sure your information is safe by using the latest encryption technology.

Tax Pro Reviews Available

If you want a tax expert to review your answer at a low cost, we can do that for just $5 per question.

100% Satisfaction Guarantee

We're convinced of our service and back it up with a no-questions-asked 100% satisfaction guarantee.

100% Satisfaction Guarantee

Our lightning-fast tax help service is backed by a team of tax professionals who can review all answers for accuracy and completeness. We're so confident in the quality of our service, we offer you a 100% no-questions asked satisfaction guarantee.

If you're not completely satisfied with your tax answer, we'll gladly refund or credit your fee. We stand behind our service. Your satisfaction is our top priority!

Our customers get results

100%

Customer Satisfaction

100%

Questions Answered

100%

Time Saved

What customers are saying

ZeroTax.ai is a game-changer for my tax questions. Quick, accurate answers from AI and real tax pros.

Sukhtej Sidhu

Senior Analyst

I was hesitant to try a chatbot for tax advice, but ZeroTax.ai exceeded my expectations.

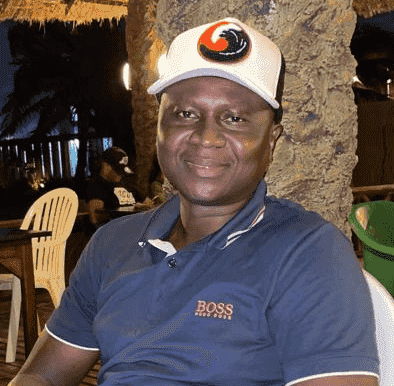

Lamin Ceesay

Painter

I've recommended ZeroTax.ai to all my colleagues. The convenience and expertise is unmatched.

Philip Kempisty, CPA

Entrepreneur

Affordable Tax Help

AI tax answers are 100% free, optional $50 tax pro reviews

Our service is accessible to all with free AI generated tax answers, and prices of just $5 per question if you want an optional tax pro review! Don't let taxes stress you out any longer - let ZeroTax.ai help you today.

AI Answered Tax Questions

100% Free

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.

- All AI tax questions answered free

- No commitment or long-term contract

- Answers in seconds

Tax Pro Reviewed Answers

Only $50

Affordable, expert tax advice for just $50 per question. Get the answers you need easily with our human-reviewed service.

- Tax professional reviewed answers

- Confirming the AI answer accurate

- Responses with in 24 hours

Our Technology

How does AI work?

Well, imagine a giant brain made up of millions of lines of code. This brain is constantly learning and analyzing vast amounts of tax-related information. When you ask your question, our technology quickly cross-references millions of pieces of tax information to find you the most relevant and up-to-date answer.

And it's even more advanced than that. Our AI technology is able to understand the written language context of your question. It takes into account your specific circumstances and provides you with tailored recommendations incorporated into your answer.

Think of it as having a personal tax expert right at your fingertips, available 24/7 to provide you with the tax information you need. Plus, our system is self-learning and constantly improving, ensuring that you always receive the most accurate advice.

Tax Tips and Tricks Right to Your Inbox

Sign up for our exclusive tax tips and tricks and always get the latest tax strategies, updates, and promotions. Don't miss out on this valuable information that will save you money and time. Tax gold right to your email.

Ready to ask your tax question?

Get started today with your tax questions for free! No risk, no commitment, just expert tax advice at your fingertips.